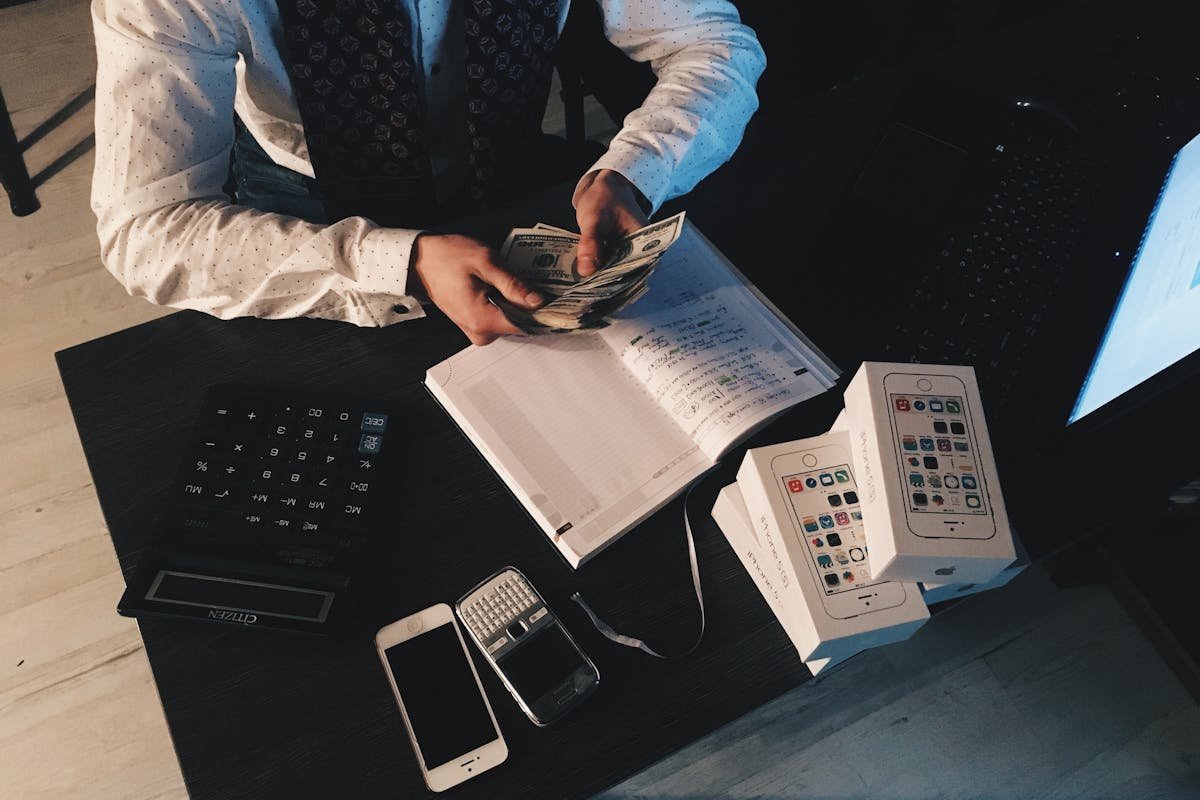

Raising funds is a fundamental element for the growth and development of many companies .

This process plays a crucial role in the business world, allowing companies to achieve their financial and strategic goals.

If you want to know how fundraising works and why it is so important for your company, read this article until the end!

Here you will learn about the five main ways to raise funds, including angel investment, crowdfunding, venture capital, public notices and IPO, as well as having a comprehensive overview of the entire process. Enjoy your reading!

What is fundraising?

Many companies, at some point, find themselves needing access to additional financial resources for their activities. And that’s where fundraising comes in.

This fundraising is nothing more than the process of acquiring financial funds through various sources, with the aim of financing a company’s activities.

These funds can be used to invest in new projects, pay down debt , hire new people, expand operations, or finance other business ventures.

Regardless of the chosen form of fundraising, it is essential that the objective and expected return are defined.

Another relevant aspect is that fundraising needs to offer advantages both to those who provide the resource and to those who raise it, as we will see later.

How does fundraising work?

In practice, the company that wants to raise funds is asking other market players to inject money into its business in order to obtain some return.

In general, the process usually involves identifying suitable sources of funding and presenting compelling proposals to attract investors or funders.

This includes preparing solid business plans, detailed financial statements and well-defined growth strategies.

The type of fundraising varies according to the size of the company, the area of activity and the purpose of using the resource. In some cases, rounds of negotiations are initiated to define values and compensation.

The possibilities can be very different for a company that wants to buy a new machine compared to one that wants to open a branch in another country or recover from debts.

How important is fundraising for the company?

Fundraising is central to business success. In the absence of funds, most businesses can be stagnant or fold. Fundraising allows organizations to mobilize the capital required to expand their activities, innovate, produce goods and compete in the market effectively.

A compelling example of the importance of raising funds even before opening a company is obtaining working capital .

According to business consultants, for a business to take off, it is essential to have working capital to sustain the company for at least a year.

If there is no equity capital for this purpose, raising funds is an efficient solution.

Top 5 ways to raise funds

Among the various possibilities available for raising funds, a company should always choose the one that best suits its profile and needs.

To do this, it is essential to understand in depth how each of the possibilities works. Check out the top 5 below:

Angel investment

Angel investing is one of the most common forms of fundraising for startups and early-stage companies.

It involves investors who are willing to finance an innovative and scalable business in exchange for equity.

These “angels” are frequently seasoned business owners who offer helpful networking and advice to help the company succeed.

Because they believe in the company’s potential and assume the risks involved, the consideration requested by these investors is usually a substantial shareholding in the company being created.

Crowdfunding

More and more sought after, crowdfunding is a revolutionary method of financing whereby many people donate small funds to fund an enterprise or firm.

It’s a bit similar to an internet-based crowdfunding campaign. Companies and entrepreneurs initiate web campaigns to garner funds from a wide audience base, typically being conducted through special websites that organize crowdfunding.

There, the timeframe, objectives and purpose of the fundraising are laid out, together with the reward that will be given to investors.

If the target is not reached, the money is returned to those who contributed.

Venture capital

Venture capital is a source of finance for small companies with high growth prospects and wishing to fly quickly. Under this modality, venture capital firms invest capital in return for a substantial shareholding in the new firm.

Because it plays an active role in the accelerated growth of the new business, this type of financing is highly sought after by companies.

Notices

Requests for proposals are funding sources usually made available by non-profit organizations, foundations or government agencies. Businesses submit applications for these calls for proposals in order to receive funding for particular projects that qualify according to set criteria.

They are publicly advertised and outline the criteria and requirements for qualifying projects. This type of fundraising is prevalent in fields like education, research and technology development.

IPO (Initial Public Offering)

The process by which a business goes public and sells shares to the general public on the Stock Exchange for the first time is known as an Initial Public Offering (IPO).

This can generate a significant flow of capital into the company, allowing for large-scale expansion and investment.

However, companies that go through this process become publicly traded companies and are subject to strict financial regulations.

Conclusion

In short, fundraising plays a crucial role in the growth and success of companies. Understanding the different financing options available and how to take advantage of them is a very important step for your business.

Whether through angel investment, crowdfunding, venture capital, public notices or an IPO, fundraising can offer valuable opportunities for companies of all sizes . Good business!